An Amateur's Guide to Investing

You’ve started a new job or perhaps you’ve been at the same job for some time now. You have a steady income that you use to pay for your living expenses, the occasional dine-out with friends, and some leisure activities. If you have savings lying around, then you’re in a good spot. You might have been told to invest those savings, but you don’t know quite where to start. Investing can be overwhelming at first, but it’s never too late to begin. This guide is intended to be accessible and hit on the fundamental ideas on how to start investing your money. The main topics we will walk through are budgeting and goal setting, setting up an investment account, and asset allocation via the three-fund portfolio.

Before you start investing

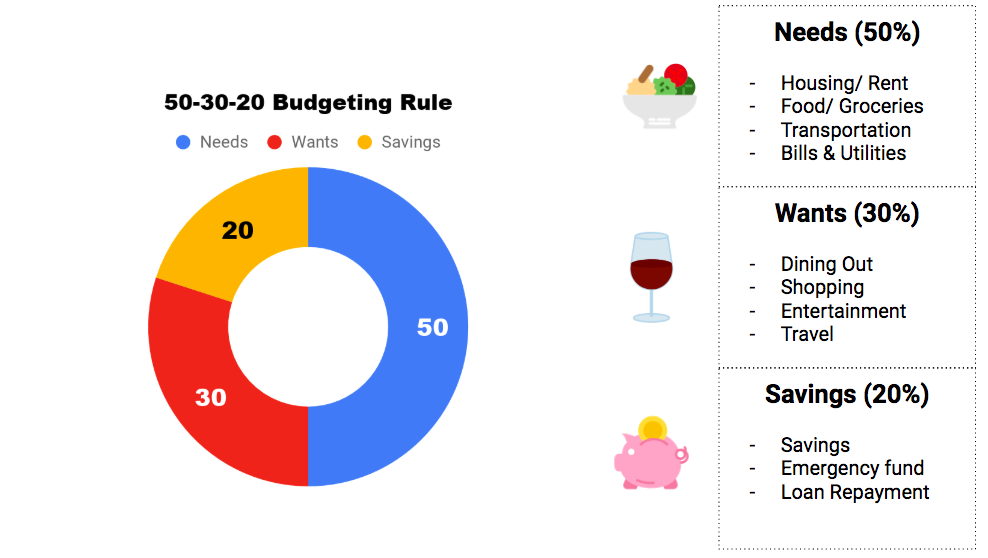

Budgeting and goal setting— One of the very first things you should do when managing your finances is to sit down and budget your monthly spending. How you spend will inform how much you can save and invest those savings. A general good rule-of-thumb is the 50/30/20 budget rule popularized by Senator Elizabeth Warren. You divide your after-tax income and allocate it to 50% on your “needs” (living expenses), 30% on “wants” (leisure), and 20% on savings. When you’re young, it’s a good habit to really maximize your savings.

Image by © moneylover.me

Image by © moneylover.me

Equally important to budgeting, though, is to determine your financial goals early-on. Pay off any high interest loans and have an emergency fund set up. List out the tangible investments you want to make in the near-term and long-term. For most people, a car and a house will generally be their most important tangible investment in their life. If you have goals setup early, then you know how much you are going to need to save to reach those goals. You might have to save more and spend less on “wants” at times to reach certain financial goals.

Setting up an investment account

To start investing, you are going to need some sort of account that lets you put money into and grow. The two main types of investment accounts are retirement accounts and brokerage accounts. Retirement accounts are used to invest for retirement and money invested is withdrawn after age 59.5. Brokerage accounts are used for general investing with flexible time horizons and no withdrawal restrictions. Retirement accounts and brokerage accounts typically offer the same array of asset classes- stocks, mutual funds, ETFs, bonds, CDs, money market. The key difference is that retirement accounts are tax-advantaged, while brokerage accounts are taxable.

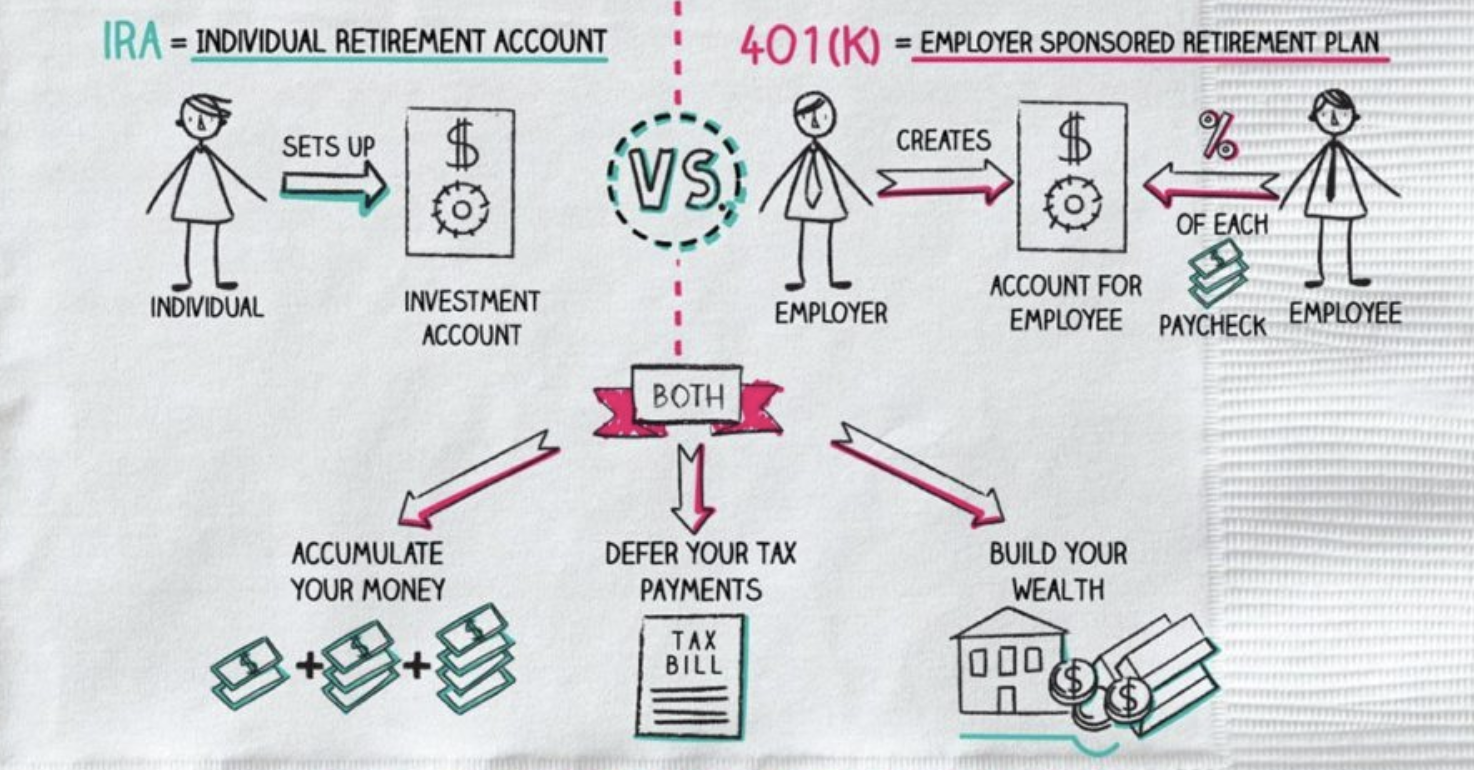

401(k) Plan— This is the first investment account that you should try to maximize your savings in. The 401(k) is a company-sponsored retirement account with a number of investment assets (typically mutual funds) in it to which you can contribute money from your income and your employer makes matching contributions. A matching contribution means your employer contributes money to your 401(k) account based on the amount of money you contribute to the plan. For example, company X might offer employee Y a 100% match if Y contributes 3% of their income to their 401(k) plan – that 100% match is basically free money from your employer. Hence, always contribute enough of your payroll to your 401(k) plan to get a full match. Note that contrary to the other account types we will talk about here, the 401(k) is actually setup by your employer, so don’t worry about having to set it up yourself.

IRA— The Individual Retirement Account or IRA, is another retirement account that you should seek to maximize your savings in. Similar to a 401(k), an IRA is tax-advantaged, funds can only be withdrawn after a certain age without a penalty, and contributions must come from earned income. The key differences are that you independently setup and manage an IRA account, there are sometimes more asset classes, and contribution limits are lower.

Image by © napkinfinance.com

Image by © napkinfinance.com

Brokerage— So you might ask, what if I don’t want the restriction of withdrawal at a much later date? Say you want to invest some money now in the market, but you want that money to accumulate and be withdraw-able in 5 years so you can make a down-payment for a house?

This is where the brokerage account comes in. A brokerage account is a non-retirement investment account that allows you to invest in a broad range of assets without withdrawal restrictions. You deposit money with a brokerage firm that executes investment transactions on your behalf. Because you can withdraw funds relatively fluidly, brokerage accounts give greater flexibility to the duration of investment. The disadvantage is that any interest or dividends you earn on investment gains are taxable the year it is earned.

What account should you contribute to?— Start with the 401(k), and build from there with an IRA and brokerage account. How you divide up your savings into these investment accounts will depend on a number of factors that relate back to how you budget and set goals as we talked about previously. Planning your goals early will help you determine how much you want to invest for retirement and how much you want to invest for more near-term goals (5, 10, 20 years). Generally speaking, though, it is a good idea to maximize your retirement accounts as much as possible to obtain the tax benefits.

What to invest in — Asset Allocation

You have an investment account now and you might be wondering, what do I invest in and how do I properly allocate my account’s assets? This is known as asset allocation, and there are a number of strategies that one can employ. The one I will suggest here for starters is the three-fund portfolio. The three-fund portfolio is simple, low cost, tax efficient, well diversified, has broad exposure to market cap-sizes, and best of all, consistently yields good long-term returns with minimal management – all traits we look for in a good portfolio.

Three-fund portfolio— The three-fund portfolio uses three basic asset classes: a domestic stock “total market” index fund, an international stock “total market” index fund, and a bond “total market” index fund. For starters, an index fund is a portfolio of stocks or bonds structured to replicate the composition and performance of a financial market index (e.g. S&P 500, Dow Jones, NASDAQ). If the S&P 500 goes up, then an index fund that replicates it would also grow in value. Because markets have historically yielded strong returns in the long-run, index funds perform well if you hold out for the long run. The domestic “total market” index fund will typically provide a comprehensive measure of small-cap, mid-cap, and large-cap US equity securities. This will give you broad exposure to the US market without having to hand-pick any specific stocks. The international “total market” index fund seeks to do the same with varied international equity securities, giving you further exposure to the emerging international market. A bond “total market” index fund provides exposure to the US bond market, a market less volatile than the stock market to balance out your portfolio.

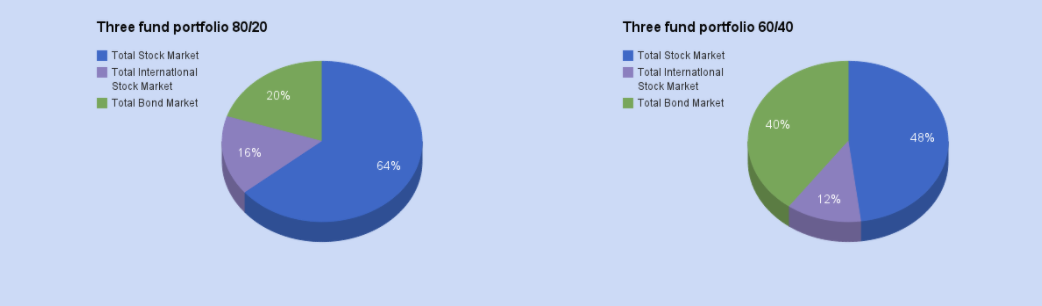

Choosing asset allocation percentages— Because stocks and bonds yield different risks, how much percentage you choose to allocate into each three funds in your portfolio will depend on how risk-averse you are. Stocks tend to be more volatile than bonds. Therefore, a greater allocation into stocks would be more risk-seeking. The younger you are, the more risks you can and should take with your investments, while the older you get the more risk-averse you should be. A good rule-of-thumb is that your stock allocation percentage = 100 - [your age]. Once you’ve decided how much to allocate in stocks and bonds, you need to determine your breakdown for domestic and international stock index funds. Since domestic and international stock index funds have similar long-term returns, this decision is less critical. That being said, it is generally a good idea to have much more of your stock allocation in domestic stocks. International index funds come with risks such as currency volatility, economic fluctuation, and political instability that are all less predictable than US markets. Below are two possible asset allocations, with the left being more aggressive and right being more conservative.

Image by © bogleheads.org

Image by © bogleheads.org

Choosing an account for your asset— You might be asking at this point, should I invest in these three funds in my retirement or brokerage account? The answer to this question depends on the tax-efficiency of the funds. A fund’s tax-efficiency depends on both its expected return and the tax rate on such return as determined by US tax codes. Assets with low dividends and capital gains tend to be more efficient. Because retirement accounts are tax-advantaged, you want to invest in the funds that are taxed heavily and less efficient in your retirement accounts. In contrast, more tax-efficient funds can go in your taxable brokerage accounts. Bond index funds are generally tax-inefficient so I would recommend you invest those in your 401(k) plan or IRA. Total market index funds (e.g. domestic and international ones) are generally tax-efficient so you can invest those in your brokerage.

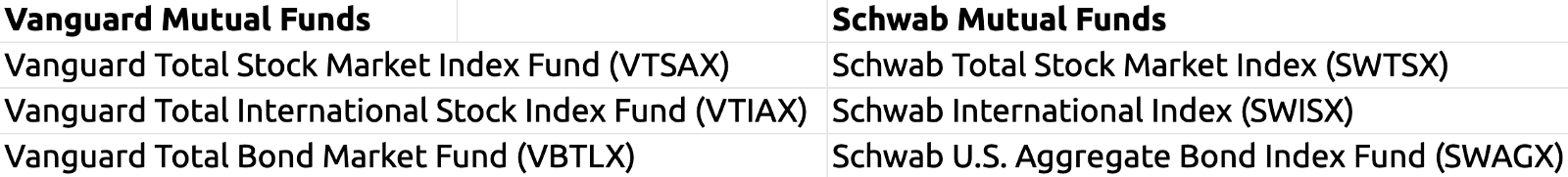

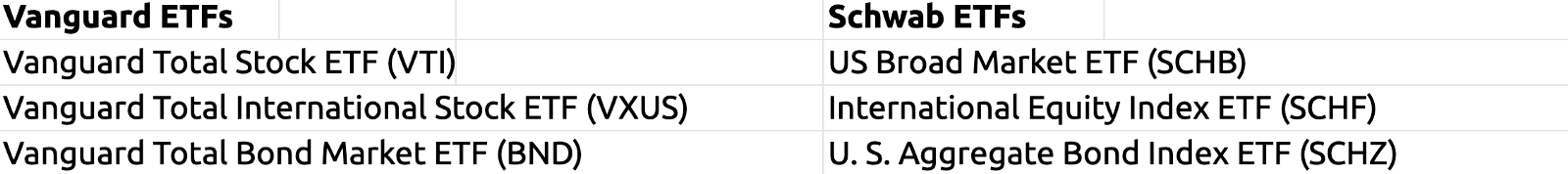

Choosing the three funds— The funds you purchase and invest in come in two flavors: low-expense-ratio mutual funds and ETFs (exchange traded funds). The main difference I would pay attention to is that ETFs are traded like stocks at any hour when markets are open, while mutual funds are priced and traded at the end of the day. Because the performances are quite similar, you honestly can’t go wrong with either (it’s perfectly fine to mix the two as well).

Some of the best funds to choose from are issued by Vanguard and Charles Schwab. There are also a number of other excellent choices as well. I would highly recommend you open your retirement and brokerage accounts with Vanguard or Charles Schwab to get direct access to their funds without possible commissions. The following is a table that shows the best three-fund portfolio for Vanguard and Schwab using either mutual funds or ETFs:

How long should you hold your investments?— Historically, the market has made incredible returns in the past decades. The key word here is decades. If you hope to make the most returns on the three-fund portfolio, the best thing to do is really hold out. There are going to be economic downturns. But as history has shown time and time again, the market bounces back. Stick to the plan and don’t panic. In-fact, due to the simple, easy to manage nature of the three-fund portfolio (it’s considered a lazy-portfolio), a good idea is to just let the funds sit there and not look at them for a long time. If you hold onto your index funds for at least 5–10 years and ride out economic slumps, expect to make good returns on your investments.

When should you start investing?— If you’re investing long-term, then as soon as you can. Any time lost is money lost. With interest rates at historically all-time lows and long-term inflation always looming, you don’t want your money sitting around. Also, time in market beats timing the market. If you worry that prices will go down, know that it might just go up as well and that is time lost in the market if you keep waiting and don’t act. So if you follow the three-fund portfolio and plan to invest long-term, the best time to invest is really as soon as you can.

What’s next

In this guide, we focused mostly on investing in well-diversified stock index funds– a passive investment strategy. Additional investments you can look into include fixed income, individual stocks and equities, and real estate. Fixed income - including bonds, CDs, money market - are a great option for a steady flow of income with low risk. If you have interest in investing in specific companies or markets, look into purchasing individual shares of stock. And lastly, good real estate is an investment anyone should be looking towards for the long-term. If you made it all the way here, hopefully you found this guide useful. Thanks for tuning in.

References

[1] https://www.thebalance.com/the-50-30-20-rule-of-thumb-453922

[2] https://www.investopedia.com/terms/1/401kplan.asp

[3] https://www.investopedia.com/terms/i/ira.asp

[4] https://www.bogleheads.org/wiki/Three-fund_portfolio